AMAZON BOOK REVIEWS

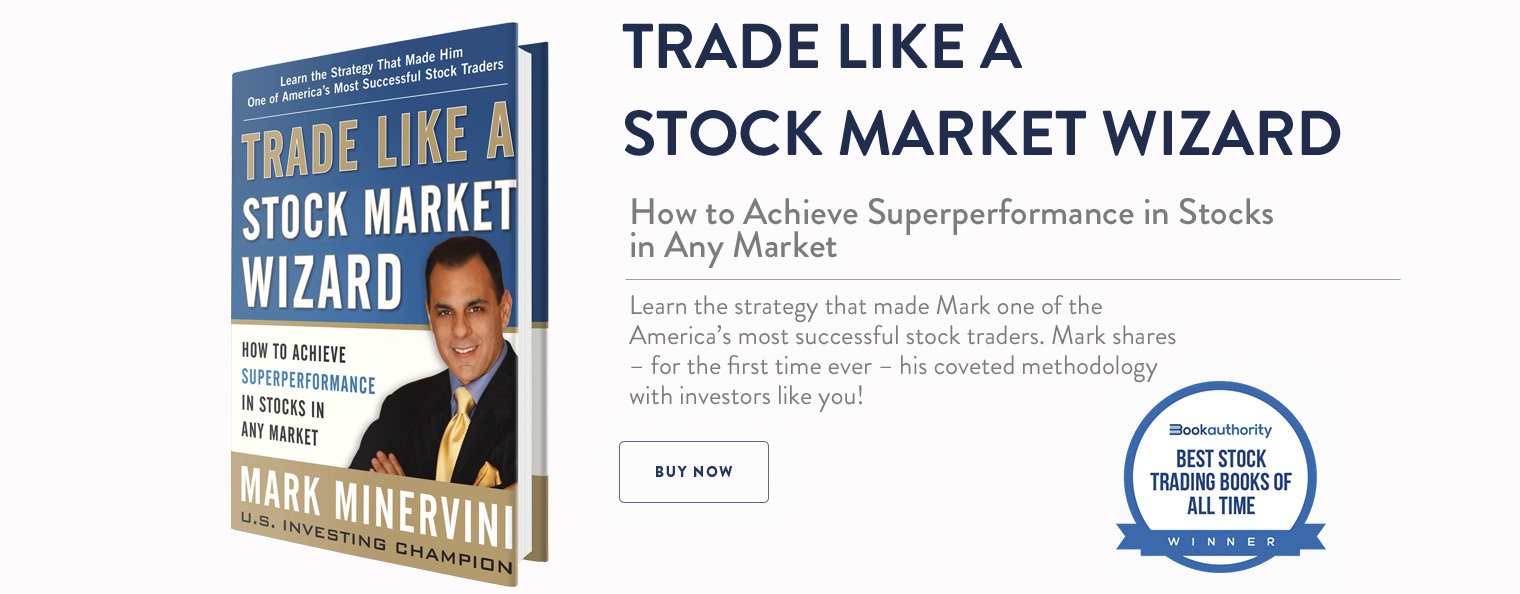

Best Trading Book Ever

This review is from: Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market (Hardcover) This book if read carefully and followed could shorten the learning curve by years for anyone trying to get into trading. I have been trading as long as the author and I learned a lot from this book. There is so much crap out there now in the "trading" book area; this is the real deal. I love the approach of fundamental and technical analysis instead of the mindless "use this setup and don't worry about what it is you are trading" lazy approach that seems so prevalent now. The risk management section should be read and reread until it is second nature. Destined to become a trading classic, possibly should also be part of a business school curriculum. Crazy low price for the information imparted.

kem60 )

Best Book I Have Ever Read on Stock

This review is from: Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market This is without a doubt the best book I ever read on stock trading. If you enjoyed the O'Neil book, "How to Make Money in Stocks", then this takes it to the next level of the game. Like O'Neil's book, you have to read Minervini's several times because it's incredibly comprehensive and detailed. The difference is Minervini's book has more actionable advice. It's very specific and "step-by-step". He conveys the lessons perfectly clear. I'm very excited to put Minervini's ideas and methods into my daily routine. I've been waiting for this book for a long time now. I knew it was going to be special when I heard that three-time US Investing Champion, David Ryan, wrote the Forward to the book.

Andrew J. Kunian "Drewmx"

Must read book

This review is from: Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market (Hardcover) This is a great book. It is an absolute steal for $13. I would pay ten times that amount for this book. Minervini's system is very similar to CANSLIM. Minervini spends the first part of his book discussing some misconceptions that many investors believe such as overvaluing the importance of PE and buying stocks because they appear cheap. In the next section he discusses the fundamental traits of big winners, such as the need for EPS and sales growth. Chapters 9 and 10 are an absolute gold mine. In chapter 9, Mark discusses how to find market leaders and in chapter 10 he discusses pivot points and how to enter the stock at the right time. If you've read How to make...

T. Caniano (NY)

Recommended recommended!

I bought this book few weeks ago. I have many years of experience in investing in multiasset, even if I changed many styles with single stocks. Few years ago I discovered O'Neill book about Canslin and I liked it a lot. I tried to use it and I passed from losing a bit to gaining a bit. But I still needed something more. I bought other 2 books in the meantime (both trend following oriented because I understood that is the style for me) and I improved my performance. But not yet at the level I liked. After thinking a lot and reading positive reviews, I decided to give a chance to Minervini book I was quite impressed, I think is a very good one and I regret it wasn't written before. I read it 3 times already, taking notes on my diary to create the plan and each time I find an idea or adv....

Mirko P.

Brilliant Book by a Brilliant Man

This is a brilliant book written by an equally brilliant person. The book should be looked at as part 2 of the author's orginal Trade Like a Stock Market Wizard. The original book describes the author's approach to taking positions in the market, including the fundamentals he looks at and the technical signals he looks for. The current book continues this discussion but is more focused on the technicals. He speaks about money management, elaborates more on the VCP concept he uses for entry and gives a more full discussion of exit techniques when you are in profit. This is the hardest part of trading and he gives multiple guidelins for exit. I must admit, I am not all that convinced that there is much more to it than the reward to risk ratio. The additional signs to look for to decide an...

Rich Feynman

The Best Investment Book... Ever

I first started taking control of my own finances sometime around 15 years ago, and like many others I suspect, I made many many mistakes. I read as much as I could, and whilst there was lots of good stuff out there that taught me loads about company accounts, BS, P&L and Cash Flow statements, and gave copious amounts of advice on the plethora of ratios that you can use to analyse specific stocks as well as charting, after years of reading although I was somewhat wiser and periodically successful, I still lacked a plan and an approach by which I could make any success I achieved stick. After ten years, I even got to the stage where I was on the point of capitulation, after a particularly unsuccessful period. It all seemed more effort than it was worth and I was ready to...

Mark

Buy A Minervini Trade Like A Champion Hat

Click Here